Real Estate Representation for Investors

Real estate investing isn’t about chasing deals — it’s about disciplined execution. It’s about making informed decisions with a clear exit strategy in mind.

I provide real estate representation for investors, builders, and developers who are acquiring, repositioning, or preparing to sell residential and multifamily properties.

This page is for investors who already understand real estate is a business — and want representation that respects that.

An Investor-First Real Estate Perspective

My background in real estate investing began inside a family business, Happy Homes, established in 2000, working through long-term holds, renovations, market corrections, and full cycles.

That lived experience shapes how I approach every investment decision today.

Before representation ever begins, I start with one foundational principle:

Begin with the end in mind.

How long do you plan to hold the property?

Is it residential or commercial?

What decisions today support that outcome — and which ones don’t?

Those answers guide everything that follows.

Selling and Repositioning Investment Properties Strategically

Most investors don’t need more activity — they need clarity.

I support sell-side representation for:

stabilized or underperforming assets

renovated or partially renovated properties

inherited or legacy holdings

properties being repositioned for sale

The focus is always the same:

align preparation with exit strategy

avoid over-improvement

position the asset so buyers understand value quickly

Buyers — especially retail buyers — don’t want work.

Strategic preparation and presentation help broaden the buyer pool and support stronger outcomes without unnecessary spend.

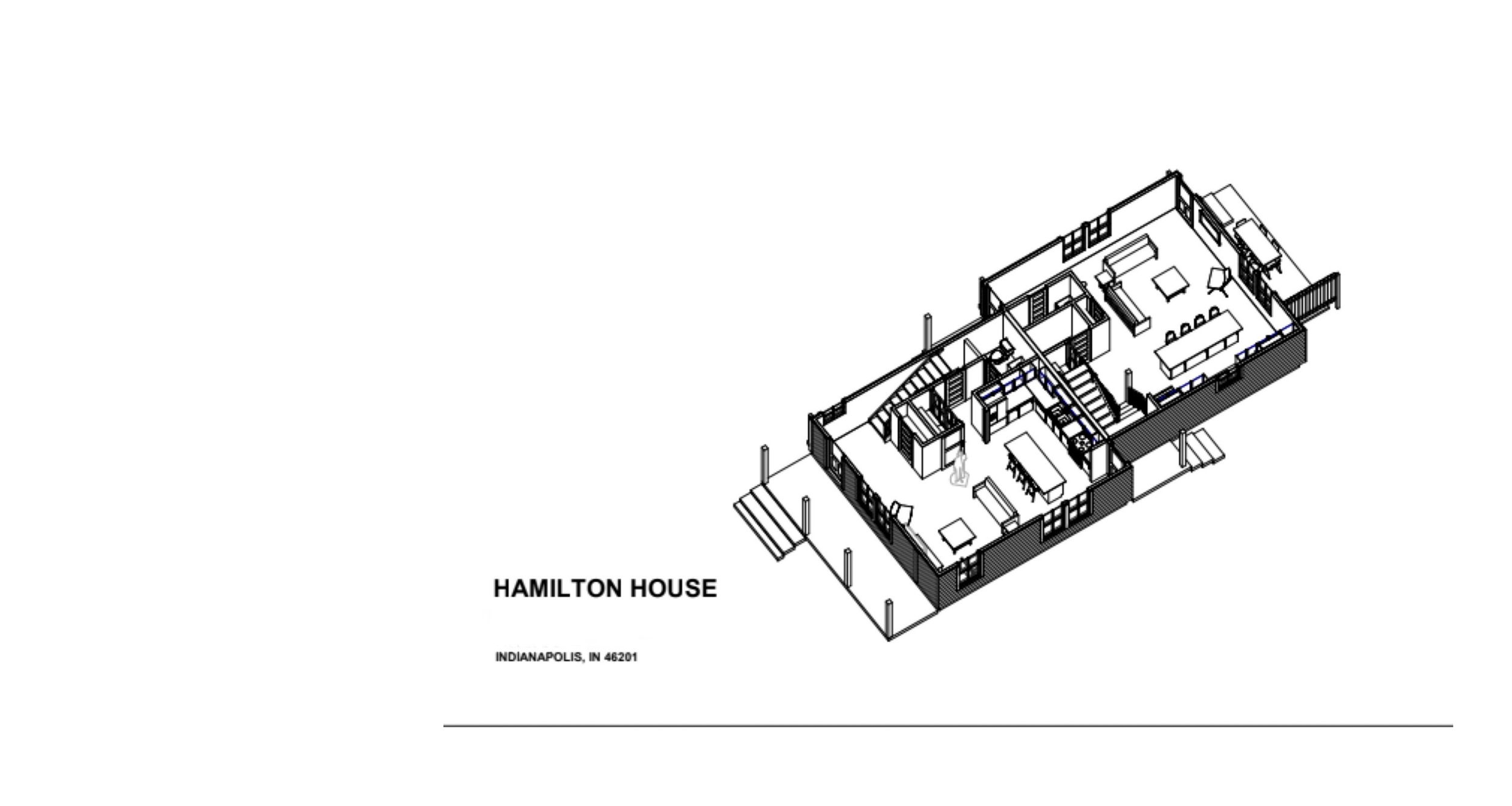

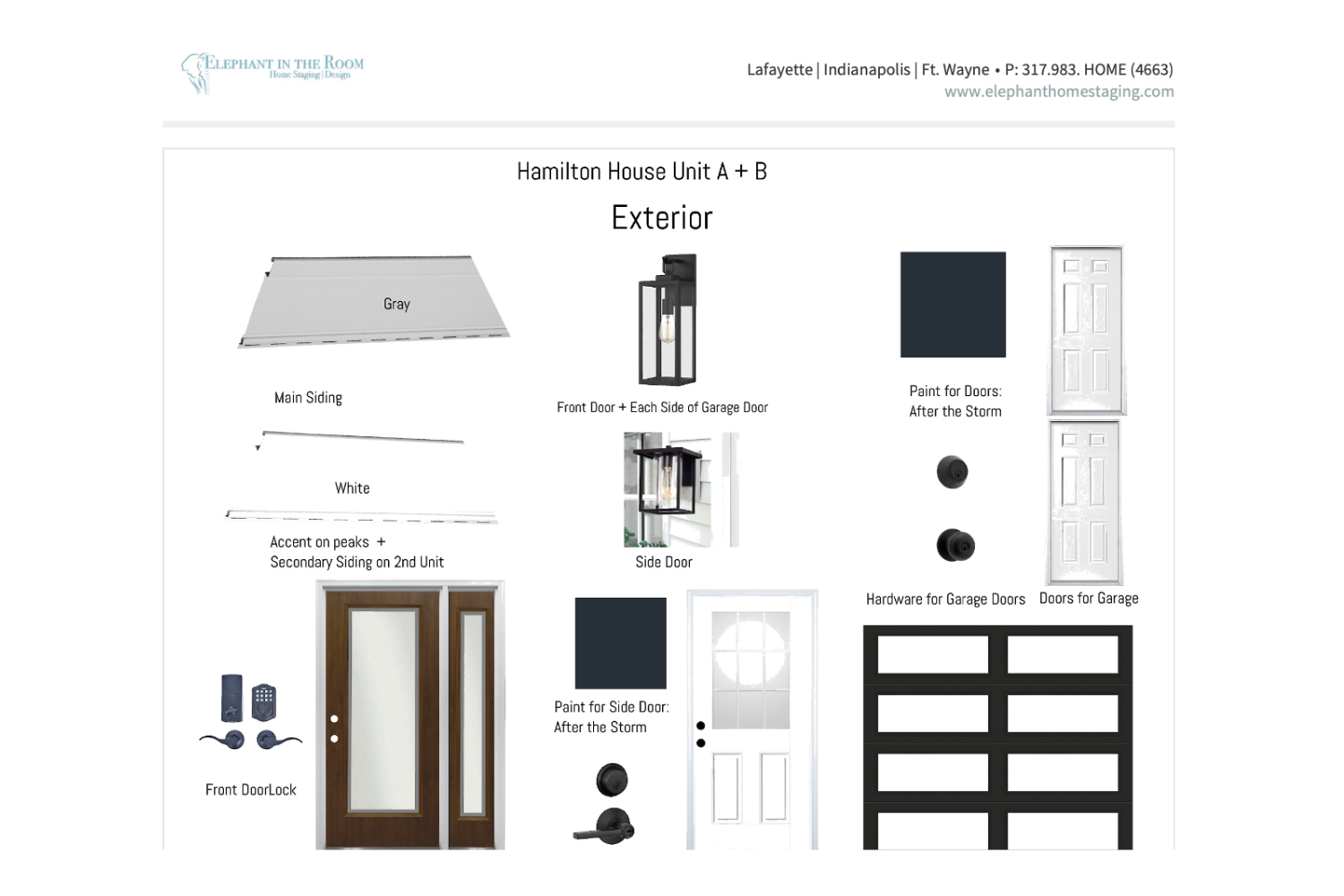

Hamilton House

Indianapolis investment property prepared for long-term rental, with resale strategy built in.

Real Estate Representation for Builders, Developers, and Multifamily Assets

I also work closely with builders, developers, and multifamily owners who need representation that understands both design and operations.

Through my firm, Elephant in the Room Interior Design, I provide:

Hamilton House

Finish and material selections developed to support long-term rental performance and resale positioning — guided by exit strategy from day one.

FF&E strategy and sourcing

model home experience and buyer flow

finish selection aligned with market expectations

design decisions that support absorption and resale

This integrated perspective is especially valuable for:

new construction

model homes

small multifamily and mixed-use assets

out-of-state investors managing from a distance

Design decisions are never aesthetic alone — they’re strategic.

Education Meets Execution

To strengthen my investment perspective, I hold professional certifications in Real Estate Development and Real Estate Investment & Finance through Cornell University – SC Johnson College of Business.

That education reinforces how I:

evaluate opportunities

assess risk and return

guide pricing and positioning decisions

support long-term value creation

Every recommendation is grounded in both financial logic and market behavior.

Who This Is (and Isn’t) For

This approach works best for investors who:

are actively acquiring, repositioning, or preparing to sell

value clear thinking over speculation

want representation that understands exit strategy

It’s not designed for:

passive education seekers

short-term deal chasing

or investors looking for hype instead of discipline

Start With a Strategy Conversation

If you’re considering selling an investment property, repositioning an asset, or acquiring with a defined exit in mind, the best place to start is a conversation.

No pressure.

No pitch.

Just a clear discussion of goals, timing, and strategy.

Schedule a call to start the conversation.